The Essential ERP Blog

Level up your knowledge of Enterprise Resource Planning with our ERP blog. Featuring insights and advice from ERP software experts and advisors.

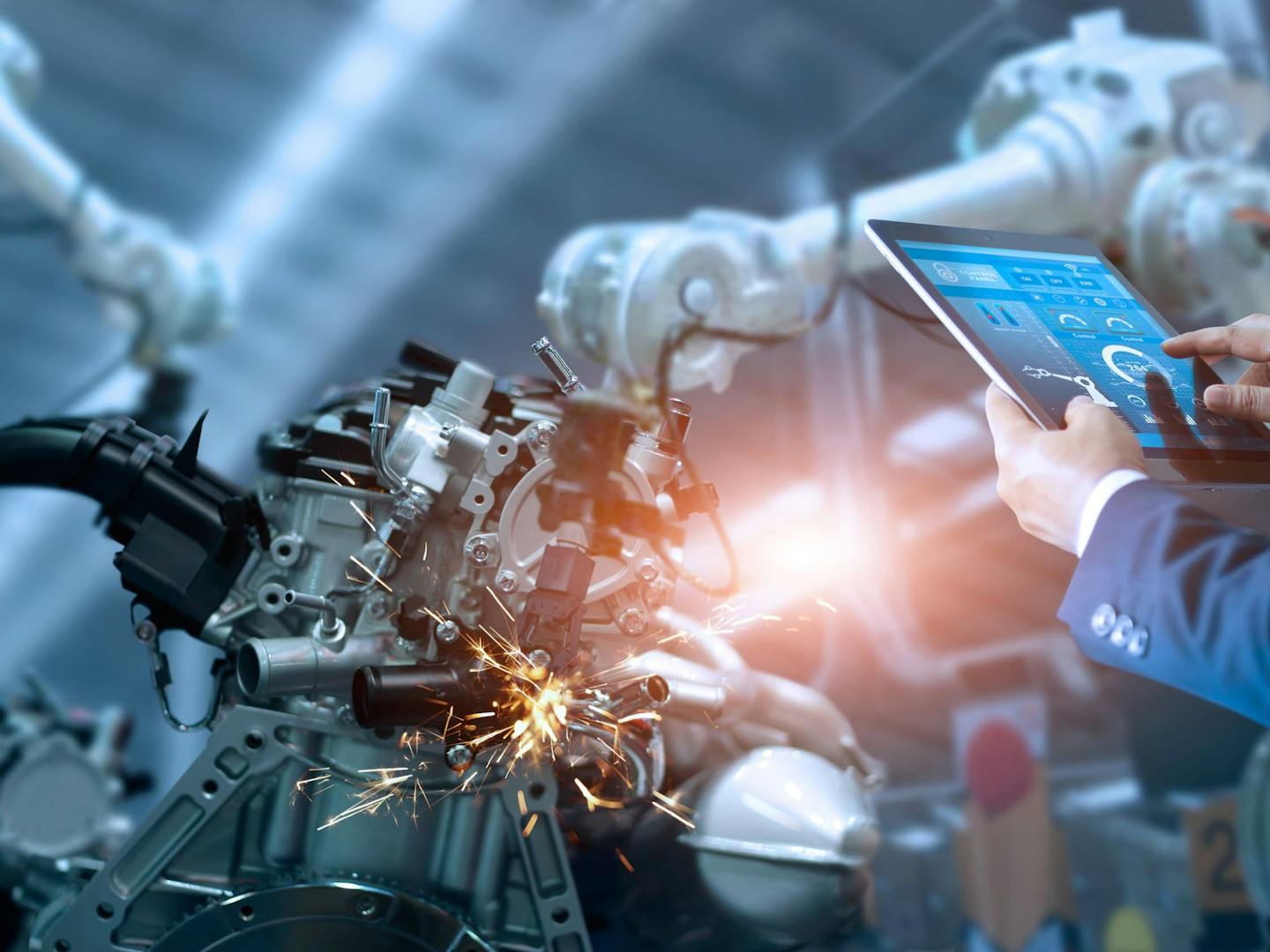

Gaining a Competitive Edge with Manufacturing Software

Manufacturing software serves as an integral backbone to modern manufacturing operations. It streamlines processes from production planning to inventory management.…

Posted In

Ready to Find a Top ERP System?

Try our "Best Fit" ERP comparison tool

Compare Top ERP

Posted In

Posted In

Posted In

Posted In

Posted In

Posted In